The blockchain landscape is evolving. Similar to how the Internet evolved from isolated networks into a seamless, interconnected ecosystem, blockchain is undergoing its own shift.

This transformation will make blockchain technology more approachable and user-friendly, particularly for those new to the space.

At present, decentralized applications (DApps) can be complicated and costly, preventing their widespread adoption.

However, the advent of multichain technologies is reshaping the narrative by enabling seamless interoperability across multiple blockchains.

In this blog post, you’ll learn about the multichain variants of $DFI, highlighting their unique characteristics and the seamless interoperability that allows users to transfer value across the DeFiChain ecosystem.

Interoperability has long been a holy grail for blockchain technology. No single chain can be a one-size-fits-all solution. The future of decentralized finance (DeFi) and Web3 lies in an interoperable, multi-chain ecosystem that combines the strengths of various networks.

Ambitious undertakings like Ethereum’s Merge are incomplete answers. They deliver long-term scalability but lack the functionality users need. The true multi-chain model is one where DeFi and Web3 are built upon a collaborative ecosystem of interconnected blockchains, each contributing its specialties.

This is far from a far-future vision. This interoperable multi-chain world is already taking shape thanks to projects like DeFiChain. Built as a blockchain dedicated to decentralized financial services, DeFiChain was designed from the ground up for interoperability.

At its core, DeFiChain is an open-source proof-of-stake blockchain that can seamlessly create and transfer any crypto asset, including wrapped versions of Bitcoin, Ethereum, and other major coins.

Powered by the Masternodes system, DeFiChain provides a trustless platform for decentralized financial applications like exchanges, loans, asset tokenization, and more.

What makes DeFiChain truly unique is its interchain operability. Through its integration of the MetaChain layer, it can interact with the Ethereum blockchain. This allows the free flow of assets between chains, unlocking new cross-chain liquidity while preventing the fragmentation seen in isolated blockchain silos.

When DeFiChain launched in 2019, it introduced $DFI as the native cryptocurrency powering its decentralized finance ecosystem. This “Native $DFI” variant was the first of its kind – a multichain crypto asset that has since become compatible across different blockchains.

Native $DFI is the fuel that powers DeFiChain’s core decentralized finance services: staking, liquidity mining, and the entire dToken system, which runs directly on DeFiChain’s blockchain.

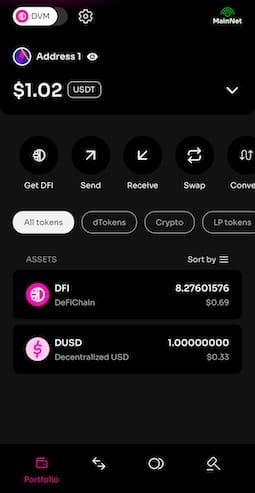

When you select the “DVM” option in the official DeFiChain Light Wallet, you’re interfacing with the native $DFI tokens. Interacting with the native $DFI variant is a seamless experience through the Light Wallet. By simply toggling the option on the upper left side to “DVM,” users can access and enjoy the extensive array of DeFi offerings available on the DeFiChain ecosystem.

In an effort to enhance the interoperability of its native DFI token and increase exposure to a broader audience of retail and institutional investors, DeFiChain has created an ERC-20 standard token version of DFI. This ERC-20 DFI token is available for trading on Uniswap with DFI/ETH and DFI/USDT trading pairs.

This ERC-20 token serves as a bridge, attracting fresh liquidity from outside the DeFiChain ecosystem while enabling improved interoperability between the DeFiChain and Ethereum ecosystems.

Uniswap users can trade DFI on the following three official DeFiChain Uniswap pools:

DFI/ETH: https://v2.info.uniswap.org/pair/0xb079D6bE3faf5771e354586DbC47d0a3D37C34fb

DFI/USDT: https://v2.info.uniswap.org/pair/0x9e251daeb17981477509779612dc2ffa8075aa8e

DFI/USDC: https://v2.info.uniswap.org/pair/0xd239216ac7e44a09da67d6852cd757fc5e829fe2

To bring “Native DeFi” to Ethereum, DFI coins must be wrapped into an ERC-20 DFI token. This process is automated in the background, making it easy and intuitive for users to withdraw and deposit DFI to and from the Ethereum ecosystem.

Please refer to this blog post here for detailed information on interacting with the ERC20 $DFI token.

A significant architectural evolution for DeFiChain came with the introduction of the MetaChain layer at the end of 2023. By implementing an Ethereum Virtual Machine (EVM) layer, called the MetaChain, DeFiChain now supports EVM transactions while retaining the security benefits of its Unspent Transaction Output (UTXO) model.

This innovative layer marks a major milestone for DeFiChain. It allows it to leverage the vast ecosystem of Ethereum-based dApps and developer tools while still harnessing the proven security and scalability advantages of the UTXO model.

With the MetaChain layer, developers can now build and deploy EVM-compatible smart contracts directly on DeFiChain, opening up new possibilities for DeFi applications, non-fungible tokens (NFTs), and other blockchain-based solutions.

To interact with the MetaChain layer ecosystem, users need to first transfer their native $DFI tokens to the MetaChain layer, which can be directly received into their MetaMask wallet. This process can be accomplished through a few simple steps, outlined in detail in this blog post.

DeFiChain continues to trailblaze the path toward a multi-chain future. DeFiChain is laying the foundation for a decentralized, open, and collaborative Web3 landscape by bridging the gap between different blockchain architectures and ecosystems.

The multi-chain variants of $DFI show DeFiChain’s commitment to accessibility, interoperability, and empowering users with seamless value transfer. As this ecosystem continues to evolve and expand, users can look forward to even more groundbreaking developments that push the boundaries of what is possible in DeFi and beyond.