Following a successful first-day trade of Bitcoin Spot ETFs in Hong Kong, popular Bloomberg Intelligence expert Eric Balchunas has taken center stage to analyze the historical introduction of the products in the country.

Hong Kong’s Bitcoin Spot ETFs Attract Notable Inflows

On Tuesday, Eric Balchunas called Hong Kong Spot Bitcoin ETFs a market for ants, as it is just 1/168th the size of the funds in the United States. He further highlighted that the debut of HK spot ETFs coincided well with the US slowdown, so their inflows will more than offset the marginally negative US flows.

Given the notable inflows seen on the first day, the Human and Machine channel called out the analyst noting that after raising more than HK$11.2 million on their first day of operation, Hong Kong’s Bitcoin and Ethereum Spot ETFs countered net outflows from the US market.

Responding to the channel’s post, Balchunas stated that he and his team recently released a memo including the final data regarding HK’s spot ETFs, which is not as timely as in the US. According to the expert, he previously projected the products would garner a $1 billion inflow in two years. However, with Hong Kong witnessing $292 million in assets on day 1, he believes his predictions might be way ahead of schedule and corrections can derail plans, as seen in the US market.

During the first day of trading, Ethereum spot ETFs took up 15% of the market, and investors seemed to be drawn to larger funds rather than lower fees. The ChinaAMC BTC spot ETF (3042 HK) with higher fees saw the highest inflow valued at $124 million on the first day. Meanwhile, other funds with lesser fees like the Harvest Bitcoin Spot ETF (3439 HK) and Bosera Hashkey Bitcoin ETF (3008 HK) saw a net inflow of $63 million and $61 million respectively on day one.

Eric Balchunas’s emphasis seemed to have fueled confusion among community members, as a pseudonymous X user questioned the analyst on the difference between the $292 million in assets and the HK$11.2 million of inflows.

Balchunas responded saying that the exact $292 million in assets that were contributed as seed money just prior to launch are not included in the volume calculation. Meanwhile, in the US, seed money is withheld until the first day to make the volume appear larger, which aids in marketing.

The Funds Sees Massive Outflows In US

The Bloomberg expert’s review came in light of the massive outflows witnessed in the US market surpassing $500 million in a day. Wednesday saw the fastest-ever selloff of US BTC spot ETFs by investors, recording a cumulative net outflow of $563.7 million.

According to data from Farside Investors, this marks the biggest outflow since the funds started trading early this year. Of the 10 Spot Bitcoin ETFs, Fidelity Wise Origin Bitcoin Fund (FBTC) saw the largest withdrawals, totaling $191.1 million.

Grayscale Bitcoin Trust ETF (GBTC) had withdrawals of about $167.4 million, while Blackrock iShares Bitcoin Trust (IBIT) saw a whopping $36.9 million withdrawn, marking its first day of outflows since its inception.

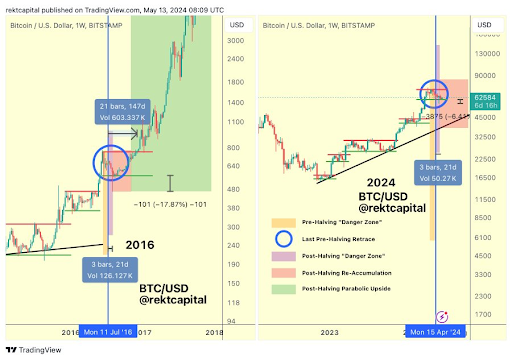

Featured image from iStock, chart from Tradingview.com