DeFiChain Labs is proud to announce its role as a Node Validator for CrowdSwap’s Cross-Chain Solution.

This development marks another milestone for DeFiChain Labs and further reinforces its commitment to sustaining critical infrastructure within the DeFiChain ecosystem.

Understanding Cross-Chain Bridges

Cross-chain bridges are specialized decentralized applications (dApps) that enable the movement of assets from one blockchain to another.

By leveraging smart contracts, these bridges lock or burn tokens on the source chain and subsequently unlock or mint equivalent tokens on the destination chain. This process increases token utility by enabling cross-chain liquidity and expands the use cases of blockchain technology.

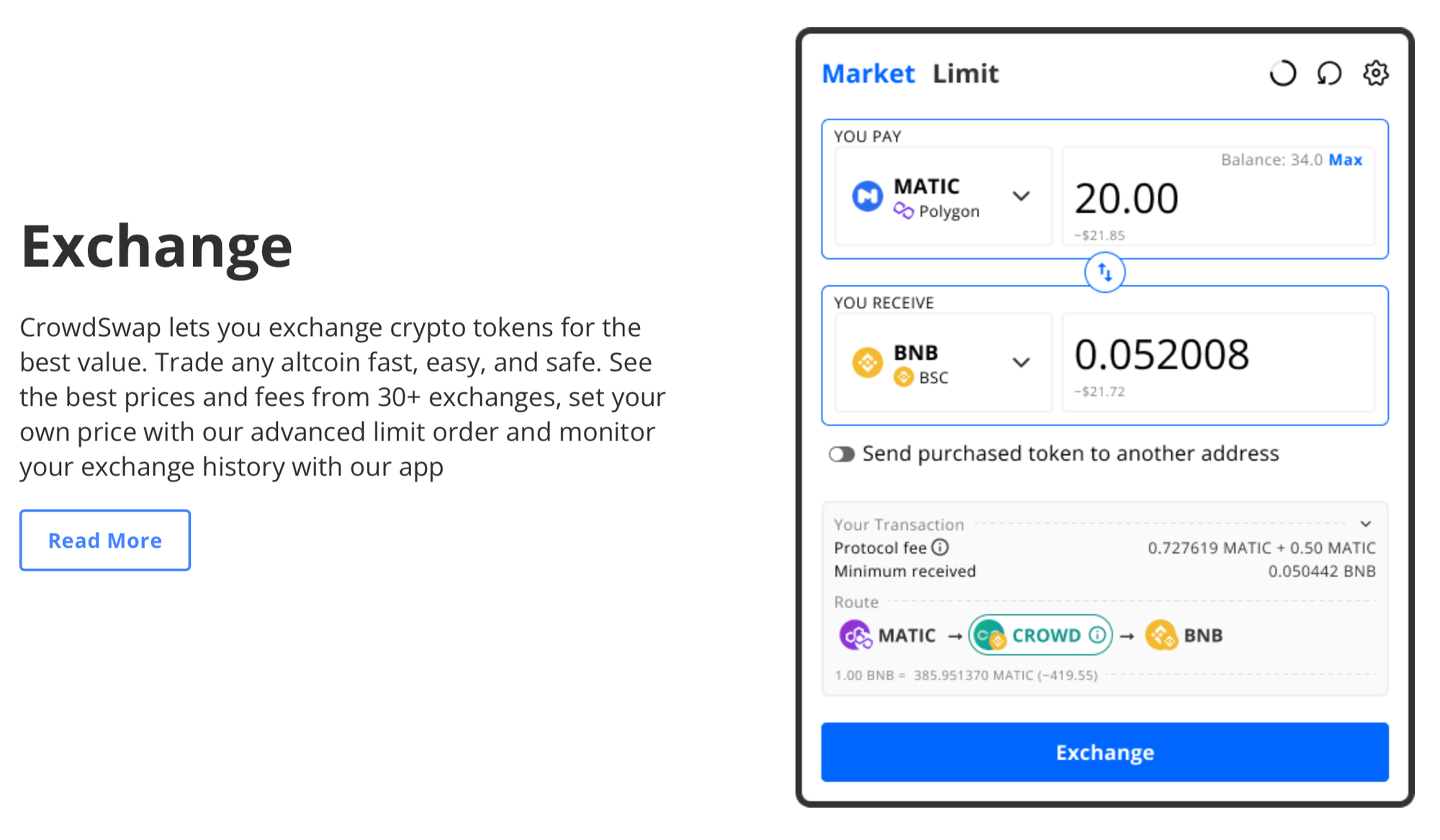

CrowdSwap’s Cross-Chain Bridge stands out for its ability to facilitate a wide range of transactions across multiple blockchains. Whether it’s transferring assets, engaging in token swaps, or accessing cross-chain money markets, this bridge serves as a critical infrastructure in the Web3 domain.

DeFiChain Labs’ Role as a Node Validator

As a Node Validator for CrowdSwap’s Cross-Chain Solution, DeFiChain Labs is tasked with verifying and processing transactions. In return for their services, they are compensated with a share of the cross-chain fees.

These fees are structured to be competitive, with a base fee of $0.50 per transaction and an additional fee ranging from 0.1% to 1%, depending on the transaction size. This fee is split equally between the CrowdSwap protocol and the Node Validators, ensuring a steady stream of income for DeFiChain Labs.

One of the unique aspects of this partnership is that Node Validators earn fees not only from transactions involving DeFiChain’s MetaChain layer but also from all cross-chain transactions facilitated by the CrowdSwap Bridge. This broadens the revenue base for DeFiChain Labs, contributing to the sustainability of the DeFiChain ecosystem.

The Broader Impact: Supporting DeFiChain’s Infrastructure

Perhaps the most significant outcome of this partnership is how the generated revenue will be used. After deducting maintenance and hosting fees, all proceeds from DeFiChain Labs’ Node Validator activities will be reinvested into maintaining critical DeFiChain infrastructure.

This reinvestment strategy ensures the continuous development and upkeep of the DeFiChain ecosystem, furthering its mission to provide decentralized financial services to a global audience.

The nature of the fees generated by the Node Validator also introduces an interesting dynamic to the market. Since the fees are earned in the assets transferred via the bridge (such as wBTC, ETH, USDC, and USDT) and then converted into DFI (DeFiChain’s native token), this creates a consistent buying pressure on DFI. Over time, this mechanism is expected to support the value of DFI, benefiting the entire DeFiChain community.

Conclusion

DeFiChain Labs’ decision to become a Node Validator for CrowdSwap’s Cross-Chain Bridge is a strategic move that aligns with the growing need for blockchain interoperability.

By hosting a Node Validator, DeFiChain Labs is contributing to the broader Web3 ecosystem while ensuring the long-term sustainability of its infrastructure.