According to recent on-chain data, Ethereum’s long-term holders have been increasing their total share of the cryptocurrency’s supply.

Ethereum HODLers Currently Carry The Majority Of ETH Supply

As per information shared by the market intelligence platform IntoTheBlock in a post on X, the supply held by Ethereum long-term holders has been on the rise. These “long-term holders” (LTHs), defined by IntoTheBlock, are investors who purchased their ETH over a year ago.

Long-term holders are less likely to sell their coins the longer they hold them, making them the least likely to sell in the market.

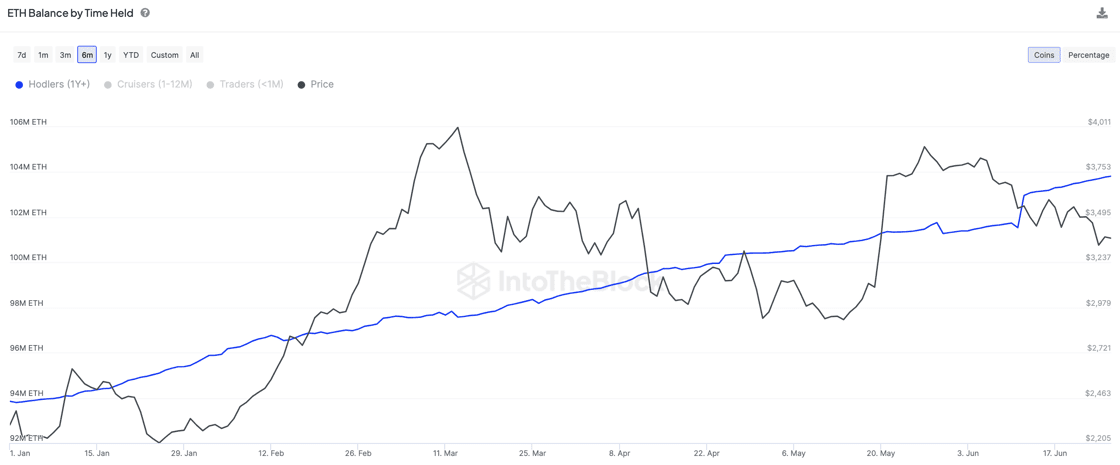

Monitoring the behavior of these HODLers can be done through the total supply they hold. The chart below illustrates the trend in Ethereum’s supply held by these holders since the beginning of 2024.

Looks like the value of the metric has been going up over the last few months | Source: IntoTheBlock on X

From the graph above, it is evident that the Ethereum LTH supply has been increasing throughout this year. This upward trend has continued in recent weeks, with a sharper increase than usual.

It is important to note that a rise in this indicator does not necessarily mean that these HODLers are currently buying. It indicates that accumulation took place a year ago, and these coins have now matured to be part of this group.

Nevertheless, an increase in the indicator is a positive sign for the cryptocurrency, indicating a growing HODLing behavior among investors.

Following the recent uptrend, Ethereum long-term holders now hold approximately 78% of the total circulating supply of the asset. This means that the majority of the supply is currently held by these holders who are reluctant to sell.

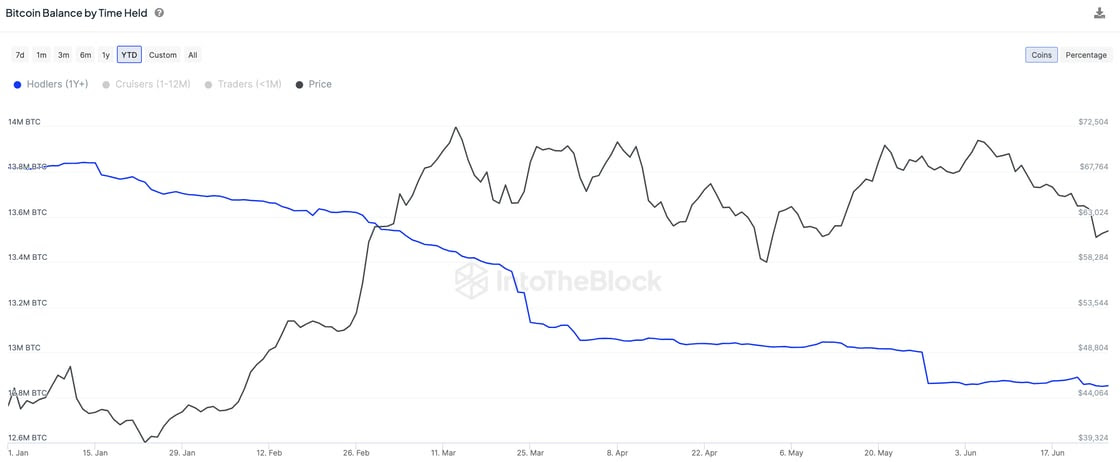

While Ethereum has seen this bullish trend with its LTHs, the same cannot be said for Bitcoin. According to data shared in another post by IntoTheBlock on X, Bitcoin HODLers have been reducing their supply throughout this year.

The value of the metric appears to have been going down recently | Source: IntoTheBlock on X

Unlike buying, selling does not have a one-year delay associated with it. Coins have their age reset to zero as soon as they are transferred on the blockchain, removing them instantly from the group.

In May, Bitcoin long-term holders sold around 160,000 BTC, valued at $10.1 billion at the current exchange rate. However, their selling slowed down last month, distributing approximately 40,000 BTC ($2.5 billion).

ETH Price

At the time of writing, Ethereum is hovering around $3,500, showing a more than 5% increase over the last seven days.

The price of the asset seems to have been on the rise over the last day or so | Source: ETHUSD on TradingView

Featured image from Dall-E, IntoTheBlock.com, chart from TradingView.com