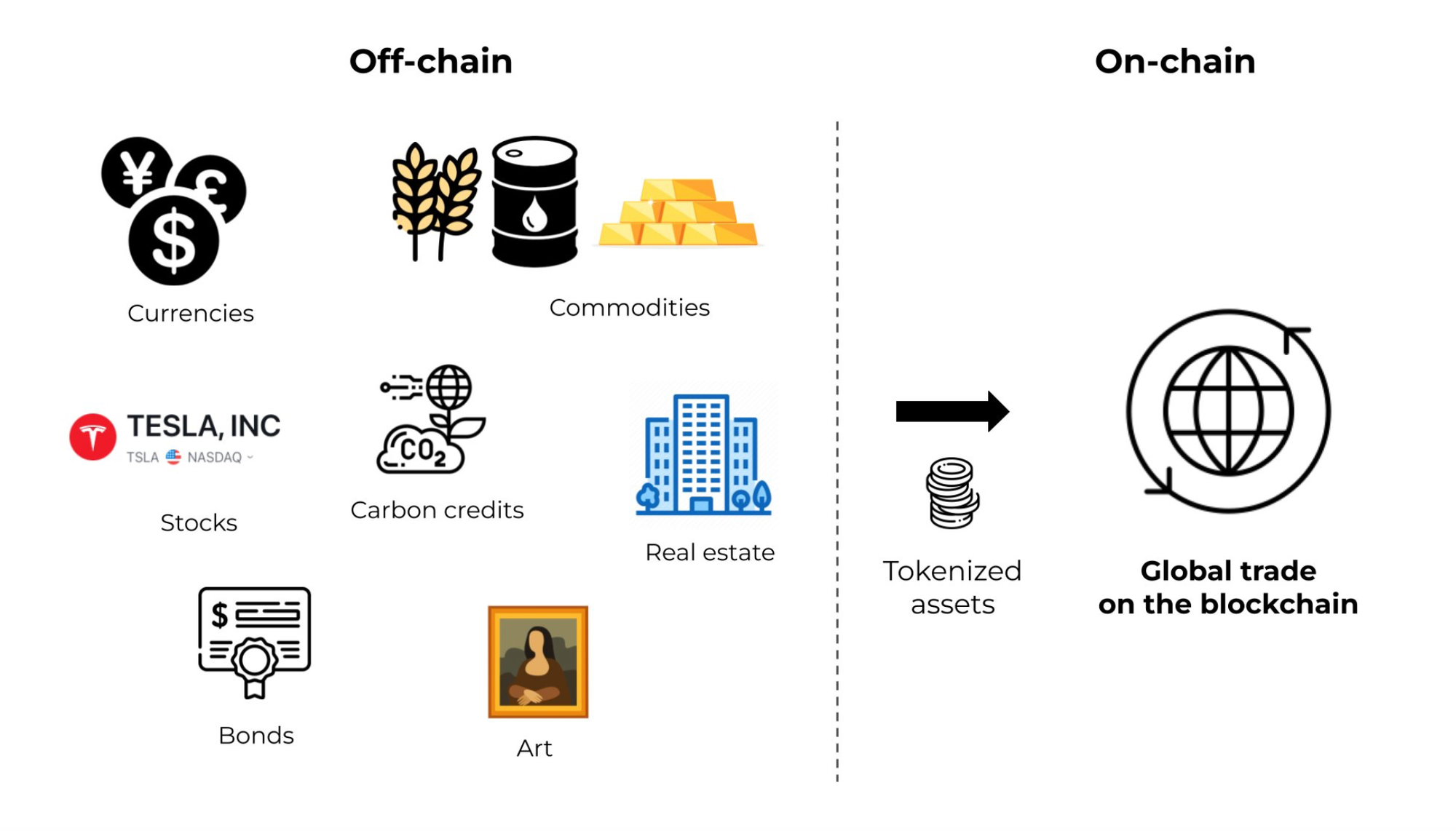

Real-world assets (RWAs) are physical or financial assets that exist in the real world, like cash, commodities, real estate, equities, and bonds. RWA tokenization refers to the process of digitally representing these assets on a blockchain as tokens.

This capability unlocks one of the largest market opportunities in blockchain – potentially representing hundreds of trillions of dollars worth of real-world value on decentralized networks.

The core premise is simple — anything of value can potentially be tokenized into a digital asset on a blockchain. This is why tokenized RWAs are emerging as one of the fastest-growing segments of the digital asset economy.

An increasing number of projects are now focused on tokenizing a wide array of real-world assets, such as real estate, art, carbon credits, precious metals, and more.

This article will provide an in-depth exploration of tokenized RWAs – explaining what they are, their key benefits, and the diverse range of assets being tokenized.

RWAs refer broadly to any assets that derive value from outside the blockchain world – whether physical objects, financial instruments, or data. Tokenizing RWAs involves creating a digital representation or “twin” of the real-world asset on a blockchain network.

Stablecoins pegged to fiat currencies like the US dollar are the OGs of tokenized real-world assets. But the possibilities extend far beyond just currencies. It’s feasible to tokenize almost any financial asset, including insurance policies, stocks, bonds, securities, and investment funds.

The range of tangible assets that can be tokenized are even more vast – precious metals, commodities, agricultural products, real estate, artwork, music rights, and more.

The appeal of tokenizing these real-world assets lies in benefits like enhanced transparency, increased liquidity, and broadened access. Costly high-value assets can be divided into smaller tokenized pieces, allowing more investors to own a stake.

This democratization of ownership could reshape investment dynamics and wealth distribution. On blockchains like DeFiChain, we already see an increase in tokenized real-world assets, from stocks and bonds to precious metals. As this ecosystem grows, a new age of borderless investing in traditional and alternative assets powered by blockchain is emerging.

More Efficient

By representing assets as digital tokens, even high-value assets can be fractionalized into smaller pieces and traded seamlessly 24/7 on digital exchanges. This allows for bypassing intermediaries like brokers and facilitating near-instant global transactions at scale. Automated protocols can more efficiently handle cross-border deals, income redistribution, and other complex processes.

Fostering Trust Through Transparency

One of the key benefits of RWA tokenization is the transparency and trust it enables. Blockchain networks provide an immutable, publicly auditable record of asset ownership and transaction history. This prevents fraud by clearly establishing provenance and title through transparent tracking of transfers, liens, and other details. Just as importantly, blockchain consensus mechanisms allow trustless atomic swaps of tokenized assets without requiring a third-party clearinghouse.

Simplified Compliance and Reduced Costs

Smart contracts can automate enforcement of regulatory requirements like KYC/AML checks for compliance. The transparent record-keeping of tokenized assets may also streamline tax obligations. By cutting out intermediaries and legacy administrative overhead, tokenization reduces the costs of issuing, trading, and managing real-world assets compared to traditional methods.

Breakthrough Liquidity and Investor Access

Tokenization unlocks a new age of 24/7 liquidity for traditional assets by creating liquid secondary markets. High-value assets can be fractionalized so that multiple investors can afford ownership stakes. This democratizes access to exclusive assets and disperses wealth more broadly. Coupled with the inherent efficiency of blockchain trading, tokenized RWAs have the potential to reshape investment dynamics and capital formation across all asset classes.

The possibilities for tokenizing real-world assets on blockchain networks are vast and ever-expanding. While stablecoins were the original tokenized real-world assets, representing fiat currencies like the US dollar, we’re now seeing projects tokenize a wide array of traditional and alternative assets:

Real Estate – Platforms like Lofty.ai and SliceSpace tokenize residential and commercial properties, enabling fractional ownership and automated operations via smart contracts. Token holders can invest in real estate globally and earn a share of rental income.

Commodities and Precious Metals – Whether it’s tokenizing gold and silver reserves (Meld), agricultural products (AgroToken), or raw materials, commodity assets are being tokenized to unlock new liquidity. Origino provides supply chain traceability for tokenized commodities.

Art, Collectibles, and Antiques – Blockchain tokens can represent ownership of one-of-a-kind artworks, memorabilia, and antiquities with digital provenance and scarcity (Artory). Fractionalization allows investment at lower price points.

Cultural Assets – Books, music, films, and other media can be tokenized as digital files, reshaping content ownership. Platforms like Book.io (ebooks) and Opulous (music) are pioneering new models for creators and fans.

Intellectual Property – Novel funding models are emerging in which innovators can sell shares (via tokens) in the future royalties and revenues from their inventions, works of art, and creations.

Asset-Backed Tokens – Many physical goods and assets are being tokenized – vehicles, electronics, luxury goods, and more. This enables fractional ownership, new resale markets, and unlocks tokenized value.

Income Streams – Now, platforms tokenize invoices and salaries, allowing individuals and businesses to access future earnings or take upfront payments by selling portions of their income streams.

These examples showcase how expansive the tokenized real-world asset domain has become. Any asset of value existing in the real world can potentially be tokenized and thus brought on-chain with all the associated benefits of blockchain-based ownership, trading, and operations. The economic possibilities are boundless.

The rise of decentralized finance (DeFi) has opened up new possibilities for tokenized RWAs to play a role in financial applications. By incorporating RWAs representing traditional asset classes, DeFi is evolving into a more comprehensive and inclusive financial ecosystem that bridges crypto markets and traditional finance. This allows DeFi protocols to offer a similar range of investment opportunities as incumbent financial institutions.

DeFi Lending and Borrowing with RWA Collateral

Leading DeFi platforms now enable tokenized assets like real estate, art, commodities, and more to be used as collateral for loan markets. Borrowers can receive stablecoins or other crypto assets by supplying their RWA tokens as collateral up to some loan-to-value ratio. This unlocks their liquidity without having to sell the underlying assets. Meanwhile, lenders earn interest by providing liquidity to these RWA-collateralized lending pools.

As an early pioneer in the RWA space, DeFiChain was among the first blockchains to introduce tokenized real-world asset, enabling anyone to create dTokens using the Vault architecture.

Tokenized Asset Diversification and Indexing

The representation of real-world asset classes as tokens allows DeFi protocols to create diversified index funds and products, providing passive exposure across baskets of different RWA tokens. This allows users to gain investment opportunities across sectors like real estate, commodities, art, and more through a single tokenized vehicle.

Autonomous RWA Asset Management

Emerging autonomous fund protocols take advantage of programmable smart contracts and decentralized oracle networks to deploy strategies to actively trade and manage baskets of RWA tokens alongside other digital assets. These protocols invest capital into diversified RWA portfolios algorithmically, aiming to generate returns for token holders.

Lower Volatility RWA Exposure

While many crypto-native DeFi assets are highly volatile, tokenized real-world assets provide lower-risk exposure to asset classes like real estate, precious metals, and commodities, which typically exhibit lower volatility than cryptocurrencies. Integrating these types of RWA investments into DeFi can help mitigate overall portfolio fluctuations.

By unlocking new lending, trading, and investment use cases for tokenized representations of real-world assets spanning both traditional and alternative asset classes, DeFi is rapidly evolving toward a more inclusive and comprehensive financial ecosystem beyond just digital currencies. The future of DeFi is bridging both worlds.

The tokenization of real-world assets unlocks vast untapped value by providing on-chain liquidity for traditional and alternative assets previously limited to off-chain existence. RWAs enable powerful benefits like 24/7 trading, fractionalization, transparency, and democratized access across asset classes with a potential multi-trillion dollar market capitalization.

Within DeFi, integrating tokenized RWAs is bridging the gap to traditional finance, fueling innovative new strategies beyond just cryptocurrencies. This convergence forms a unified, open, blockchain-based financial system leveraging crypto’s capabilities.

We are still in the early stages of this megatrend towards tokenizing all forms of value, both physical and digital assets alike. The future promises to be borderless – where any asset can fluidly exist and transfer across an open global monetary network. Exciting times lie ahead as the real-world asset tokenization wave crashes onto shores worldwide, reshaping how we invest, own, and interact with all assets of value.